Learn Everything You Need To Know About Rolling Your 401k Into An IRA.

Rules for 401k Rollover - Your Options

When you leave a job where you have a 401k plan, you typically have 3 options:

- Keep the funds in your previous employer's 401k plan (if allowed).

- Transfer the funds to your current employer's 401k plan (if it's available and if transfers are allowed).

- Transfer them into an Individual Retirement Account (IRA) with an investment firm.

However, depending on how you rollover your 401k can effect your specific tax situation or the growth potential of your wealth. All of which we cover below.

How Does A 401k Rollover Work?

Sometimes a former employer allows a direct rollover, where the money is transferred from your old 401k to your IRA company without you ever touching it. Otherwise a regular Rollover is permitted, where you receive the funds, usually in the form of a check from your previous employer, for the balance of your old 401k. Then you must forward that check to your IRA company within 60 days. It's crucial to follow the 60 day rule carefully because failure to meet this deadline could result in the distribution being treated as taxable income, subject to your regular income tax rates, and if you're under 59½, you may also face an additional 10% early withdrawal penalty. Now let’s cover rollover 401k to ira tax consequences depending on what type of account you have.

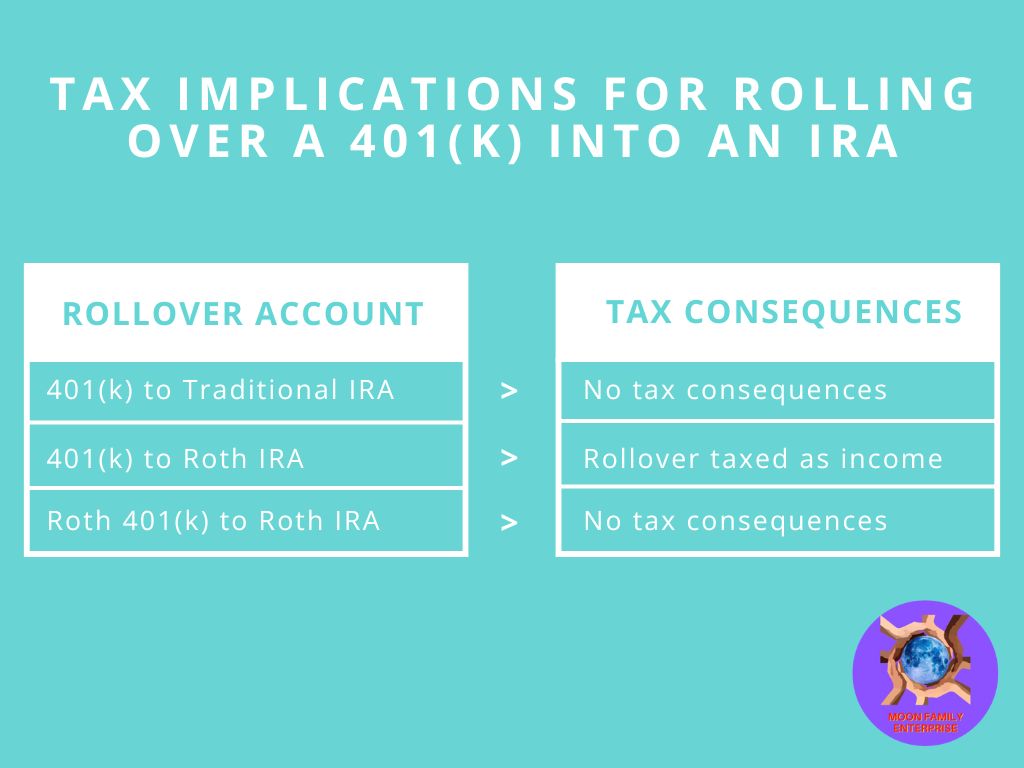

Tax Implications of Rolling Over 401k to IRA

Simple rule of thumb: Keep your IRA the same as your 401k, and there are no tax consequences. If you have a regular 401k and you're rolling over funds into an IRA, opt for a traditional IRA. If you have a Roth 401k (indicated as "Roth" on your old 401k statements), open a Roth IRA for the rollover to avoid tax consequences. Just remember to fund whichever IRA you create (Traditional or Roth) within 60 days of executing your 401k rollover to avoid IRS penalties.

However, for those who choose to rollover a regular 401k to a Roth IRA, it's important to note that your rollover amount is taxed as ordinary income. If you choose this route, the best thing to do is rollover the 401k into a traditional IRA, then convert it to a Backdoor Roth IRA, which allows you to convert a portion (or all) of your traditional IRA into a Roth IRA. This way, you can plan the correct amount to convert without putting yourself into a new tax bracket. Plus, this also avoids the scenario where, if you're under 59½, you would have to pay an additional 10% early withdrawal penalty.

Additionally, even if you're already in retirement and currently taking money out of your 401k, you can still do a rollover into an IRA if you choose.

Benefits Of Rolling Your 401k Into An IRA

Rolling over your 401k into an IRA can offer several benefits. Firstly, working with a licensed financial advisor makes the process much easier, as you have a guide who knows how to navigate the paperwork, process, and proper investments to put your money in (check out our top Asset Management 401k rollover companies below). Secondly, it provides greater control and flexibility over your retirement savings, allowing you to choose from a wider range of investment options tailored to your financial goals and risk tolerance. Additionally, consolidating multiple retirement accounts into a single IRA can simplify your retirement planning and make it easier to manage. Furthermore, IRAs often have lower fees compared to 401k plans, potentially reducing the overall cost of investing. Lastly, over time, your old 401k company will roll over your 401k into a money market. A money market is a very low interest earning type of fund, thus limiting your growth potential over time. Overall, a 401k rollover into an IRA can empower you to take charge of your retirement planning and optimize your financial future.

What Does An Asset Management Company Do?

An Asset Management Company specializes in providing comprehensive financial solutions to individuals seeking to optimize their investment portfolios, including 401k rollovers. With a team of seasoned certified financial advisors, they offer expert guidance and strategic advice to help clients achieve their financial goals, especially with 401k rollovers.

An Asset Management Company can unlock the potential to grow your wealth and generate income through various avenues. One way to make money is through capital gains, which refers to the increase in the value of your investments over time.

Additionally, you can earn grow your account through dividends, which are distributions of company profits to shareholders based on the number of shares held. Another avenue for generating income is through interest, which is earned on fixed-income investments such as bonds. Lastly, you can use mutual funds which is a combination of stocks and bonds. With these strategies, you can harness the potential of capital gains, dividends, and interest to enhance your financial well-being.

What Is A Mutual Fund, IRA, And What Is Their Relationship?

Delving into the world of investments involves understanding key components like a mutual fund, IRA, and the importance of seeking guidance from a licensed/certified financial advisor. Let's break down these concepts in simple terms.

Mutual Funds: A mutual fund is a pool of money collected from multiple investors (people in the public) to invest in a diversified portfolio of stocks, bonds, or other investments. It's a smart choice for those seeking advice from a professional asset management company without the need for individual stock picking.

IRAs (Individual Retirement Accounts): When it comes to planning for retirement, play a crucial role. There are two main types: Roth IRAs and Traditional IRAs.

Roth IRA vs Traditional IRA: Roth IRAs and Traditional IRAs have distinct features. In a Roth IRA, contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free. On the other hand, Traditional IRAs allow you to make pre-tax contributions, potentially lowering your taxable income today, with withdrawals taxed in retirement.

Certified Financial Advisor: Navigating the complexities of Roth IRA vs Traditional IRA and maximizing your retirement savings often requires the expertise of a certified financial advisor. These professionals, sometimes referred to as a licensed financial advisor or fiduciary, can provide tailored advice based on your financial goals and risk tolerance.

Wealth Management and Retirement Planning:

Wealth management goes beyond individual investments, incorporating a holistic approach to financial planning. A certified financial advisor specializing in wealth management can help you create a personalized strategy for achieving your financial goals, especially in the realm of retirement planning.

What Are The Best Asset Management 401k Rollover Companies?

Determining the best asset management company requires careful consideration of individual needs and circumstances. We understand that everyone's situation is unique, and that's why Moon Family Enterprise represents many different asset management companies when assisting with rolling over a 401k into an IRA.

Whether it's Invesco, Fidelity, Franklin Templeton, or one of our other top tier asset management companies, each partner brings a distinct set of strengths and expertise. This allows clients to find the ideal match for their investment goals, risk tolerance, and financial preferences.

Our Top Tier 401k Rollover Companies We Represent

Why Choose Us For A 401k Rollover - Moon Family Enterprise

When individuals attempt to manage their own investments, they expose themselves to inherent risks and potential financial pitfalls.

According to a study by DALBAR, the average investor managing their own money tends to significantly underperform the market, with the 20-year average annual return for equity mutual fund investors being only 5.19%, compared to the S&P 500 index's average annual return of 7.47% during the same period.

Similarly, investors who utilized a financial advisor benefited from an average annual return that was approximately 3% higher compared to those who managed their investments independently. These statistics highlight the dangers of self-directed investing and underscore the importance of working with an asset management company.

By leveraging our expertise, proven investment strategies, mutual funds, and meticulous risk management techniques, individuals can enhance their investment performance and navigate the financial landscape with confidence, ultimately achieving their financial goals.

Contact Us For A Free 1 on 1 Rollover 401k To An IRA Consultation

Thank you for getting in touch!

One of our colleagues will get back to you shortly.

Have a great day!

Rollover 401k To IRA Client Testimonials

Quinn & Nikki S.

Yucaipa, CA

We have enjoyed the personal 1 on 1 attention to detail and personal touch of working with Moon Family Enterprise. We felt like we have known them forever in our first meeting. They have helped us significantly grow our wealth.

Cody & Halee R.

Xenia, OH

I've loved working with Moon Family Enterprise because just knowing we are on track to hit our financial goals is amazing. Plus they are helping us reach our retirement goals 5 years sooner!

Charlene T.

Glendora, CA

Thanks to Moon Family Enterprise and what they teach I am able to be retired today. I rolled over 30 years of old 401ks and they solidified my retirement assets. I retired the same year COVID-19 started and even with a world pandemic, when the stock market went crazy, I had peace of mind knowing my retirement was secure.

Cody P.

Eugene, OR

Moon Family Enterprise and its affiliates have been indispensable mentors. I have processed several 401k rollovers with them and will continue to use them in the future.

Spencer & Chelsea H.

Saratoga Springs, UT

Our wealth management experience with Moon Family Enterprise has been great. They personally took the time to teach us and made sure we understood all our options and helped us create a lot more wealth for our family tree.

Jim M.

Globe, AZ

Moon Family Enterprise has been instrumental in the success of my early retirement. Because Moon Family Enterprise, I'm now retired because they doubled what I had for retirement otherwise I would be working til the day I died. Plus the rollover process was really simple with them.

Shannan & Rick R.

Santa Ana, CA

We make a decent income for our family but without the education that Moon Family Enterprise teaches, we would have worked until the day we died. I'm happy with their service and have used them for multiple 401k rollovers.

Scott & Brooke M.

Burkburnett, TX

These guys have been super helpful for helping us accumulate a 6 figure investment at a young age. What they do really works for any family.

Troy & Heidi H.

Fort Mohave, AZ

As school teachers Moon Family Enterprise has taught us and held us accountable to have more saved than we ever have had. Plus they got us on track to retire instead of working forever.

Moon Family Enterprise

3707 E Southern Ave., Mesa, AZ 85206

Moon Family Enterprise © Copyright 2024, All Rights Reserved.

This website is for informational purposes only and should not be construed as a solicitation to sell or an offer any products or services.

Moon Family Enterprise, LLC does not offer any financial products. It refers to licensed financial professionals for services such as financial advising and investment advice.

A financial advisor’s ability to offer products and services is restricted based on the licenses held by the advisor, and the states in which the advisor is registered. Not all financial advisors are authorized to sell all products and services in all states.

Investors should carefully consider the investment objectives, risks, charges, fees and expenses of any mutual fund before investing. This and other important information can be found in the fund’s prospectus and, if available, the summary prospectus. Please read the prospectus and, if available, the summary prospectus carefully before investing.